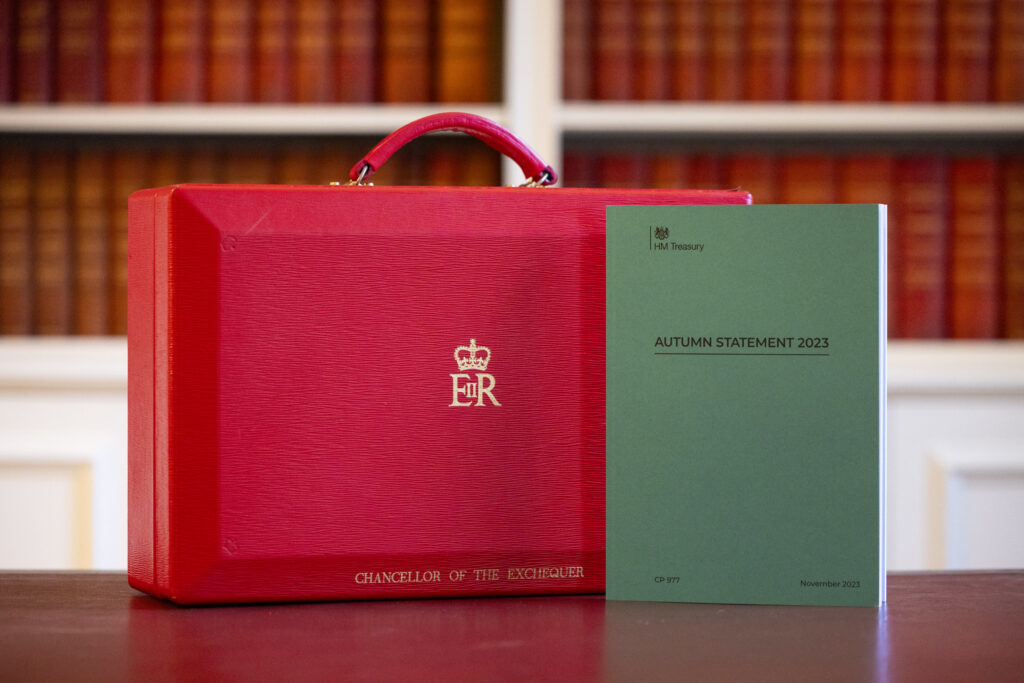

Chancellor Jeremy Hunt has unveiled his Autumn Statement, delivering what he claims is “the biggest business tax cut in modern British history” and which hopes to see tens of thousands more people return to work.

Key points include:

Tax

With inflation halved and debt forecast to fall, Hunt delivered on the government’s commitment to cut taxes – rewarding and incentivising work as part of its long-term plan to grow the economy.

- The main rate of Employee National Insurance will be cut by 2 percentage points from 12% to 10%, coming into effect from January 2024. For the average worker earning £35,400 a year, that amounts to an over £450 annual tax cut.

- The combined rate of income tax and National Insurance for employees paying the basic rate of tax will therefore fall from 32% to 30% – the lowest combined basic rate since the 1980s.

- The rate of Class 4 NICs on all earnings between £12,570 and £50,270 will be cut by 1p, from 9% to 8% from April 2024.

- The weekly Class 2 NICs – the flat rate compulsory charge which is currently £3.45 paid by self-employed people earning more than £12,570 – will effectively be abolished, with no-one required to pay from April 2024. Access to contributory benefits will be maintained and those currently paying voluntarily will still be able to do so at the same rate.

- The cuts to Class 4 and Class 2 together amount to a tax cut of £350 a year for the average self-employed person on £28,200, with around 2 million individuals to benefit.

Business

As signalled at the Spring Budget, the chancellor announced the full expensing scheme – currently due to expire in 2026 – will be made permanent.

This allows businesses to write off the entire cost of spending on new machinery and equipment, while also saving 25p from every pound spent on other types of investment.

To further ensure that work pays, Hunt confirmed that the National Living Wage will increase by nearly 10% to £11.44 an hour from April 2024, the largest ever cash increase.

A business rates support package worth £4.3 billion over the next 5 years was also announced aimed at helping high streets and protecting those small businesses that are the backbones of communities. This includes freezing the small business multiplier for a further year and extending the 75% discount on business rates up to £110,000 discount for retail hospitality and leisure businesses for another year.

These measures, Hunt said, will save the average independent shop over £20,000 and the average independent pub over £12,800 next year.

Work and welfare reform

Hunt set out steps to reward work, help make work pay, and reform welfare in recognition of the need to expand the workforce and get those out of work back into work to deliver growth. The OBR expect that the measures announced at Autumn Statement will support a further 78,000 people into work by 2028-29, on top of the 110,000 resulting from action taken at Spring Budget.

- From 1st April 2024, the National Living Wage will increase by 9.8% to £11.44 an hour for eligible workers. For the first time this will include 21- and 22-year-olds. This represents an increase of over £1,800 to the annual earnings of a full-time worker on the NLW and is expected to benefit over 2.7 million low paid workers.

- The government will also substantially increase the National Minimum Wage rates for young people and apprentices: for people aged 18-20 by 14.8% to £8.60 an hour, for 16-17 year olds and apprentices by 21.2% to £6.40 an hour.

- The government is reforming the Work Capability Assessment to ensure that people who can work are supported to do so via the welfare system. Changes to the activities and descriptors will better reflect the greater flexibility and reasonable adjustments now available in the world of work, preventing some individuals from being deemed not fit for work and ensuring they will be better supported into employment.

- The government is exploring reforms of the fit note process to provide individuals whose health affects their ability to work with easy and rapid access to specialised work and health support.

- Mandatory work placements will boost skills and employability for those who have not found a job after 18 months of intensive support. Those who choose not to engage with the work search process for six months will have their claims closed and benefits stopped.

For the full Autumn Statement, click here.

Recent Posts

- The Cod’s Scallops closes Birmingham branch

- Norway’s frozen cod exports drop in first half of the year

- Marine scientists recommend quota cut for cod but increase for haddock in 2026

- Government sets timeline for Employment Rights Bill measures to come into effect

- National Fish & Chip Awards 2026 open with new category for menu innovation